How Property By Helander Llc can Save You Time, Stress, and Money.

How Property By Helander Llc can Save You Time, Stress, and Money.

Blog Article

Some Ideas on Property By Helander Llc You Need To Know

Table of Contents6 Easy Facts About Property By Helander Llc ExplainedSome Known Incorrect Statements About Property By Helander Llc The Only Guide for Property By Helander LlcFacts About Property By Helander Llc UncoveredThe 6-Minute Rule for Property By Helander LlcThe 8-Second Trick For Property By Helander Llc

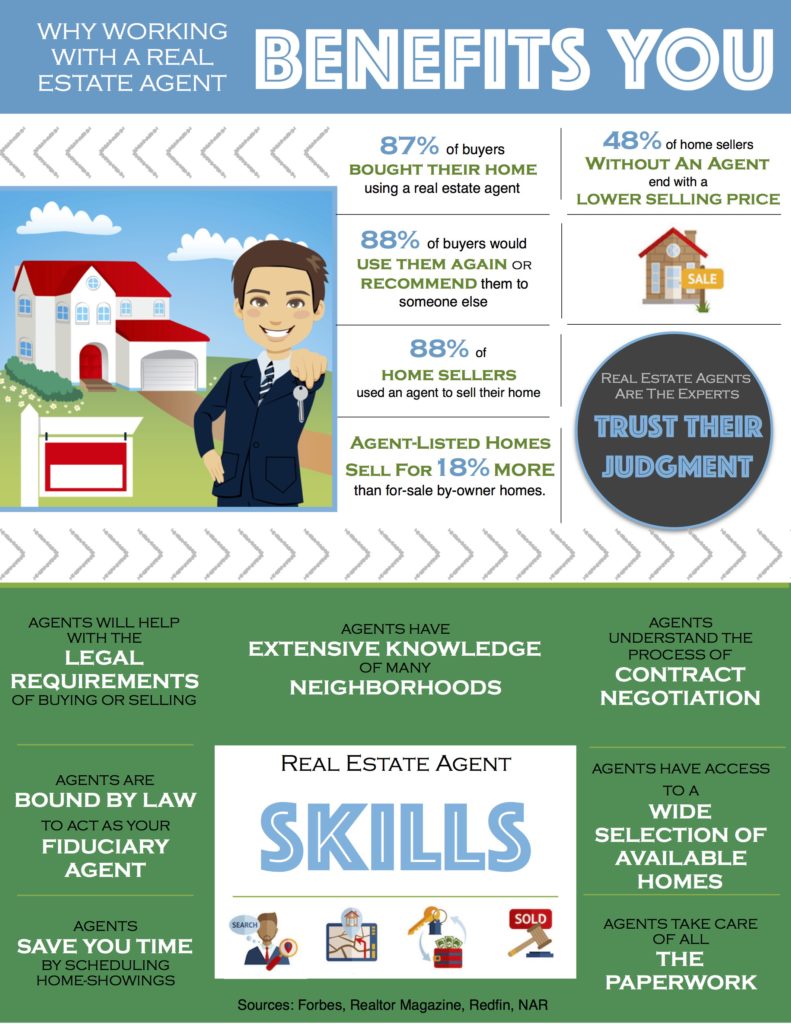

The advantages of purchasing actual estate are countless. With well-chosen assets, investors can appreciate foreseeable capital, superb returns, tax obligation benefits, and diversificationand it's feasible to utilize realty to construct wide range. Thinking of purchasing genuine estate? Below's what you require to understand about property advantages and why genuine estate is taken into consideration an excellent investment.The benefits of investing in real estate consist of passive revenue, steady money flow, tax benefits, diversity, and leverage. Actual estate investment trusts (REITs) supply a means to spend in genuine estate without having to own, run, or financing homes.

Oftentimes, capital just enhances with time as you pay for your mortgageand accumulate your equity. Genuine estate investors can make use of many tax obligation breaks and reductions that can save money at tax obligation time. In basic, you can deduct the sensible expenses of owning, operating, and handling a home.

How Property By Helander Llc can Save You Time, Stress, and Money.

Realty worths have a tendency to increase gradually, and with an excellent investment, you can make a profit when it's time to market. Leas likewise tend to increase gradually, which can bring about greater cash money circulation. This graph from the Reserve bank of St. Louis reveals average home prices in the U.S

The areas shaded in grey indicate U.S. economic crises. Average Prices of Homes Marketed for the United States. As you pay down a property mortgage, you develop equityan asset that becomes part of your total assets. And as you construct equity, you have the leverage to purchase even more properties and enhance money circulation and riches a lot more.

Because real estate is a tangible property and one that can serve as collateral, funding is readily available. Actual estate returns differ, depending on factors such as place, asset class, and administration.

5 Easy Facts About Property By Helander Llc Explained

This, subsequently, translates right into greater funding values. Consequently, real estate tends to maintain the buying power of funding by passing several of the inflationary pressure on renters and by incorporating several of the inflationary stress in the form of funding gratitude. Home mortgage borrowing discrimination is unlawful. If you think you have actually been discriminated against based on race, religious beliefs, sex, marital status, use of public help, national beginning, handicap, or age, there are actions you can take.

Indirect realty investing entails no direct ownership of a residential property or buildings. Instead, you purchase a pool together with others, where an administration company owns and runs buildings, or else owns a profile of home loans. There are numerous manner ins which possessing actual estate can protect against inflation. Initially, building worths may climb more than the rate of inflation, bring about capital gains.

Residential or commercial properties financed with a fixed-rate funding will see the relative quantity of the regular monthly home mortgage settlements drop over time-- for instance $1,000 a month as a set payment will certainly end up being less challenging as rising cost of living deteriorates the buying power of that $1,000. (https://www.startus.cc/company/property-helander-llc). Typically, a primary home is ruled out to be a realty financial investment given that it is utilized as one's home

Little Known Questions About Property By Helander Llc.

Even with the find more info assistance of a broker, it can take a few weeks of work simply to find the appropriate counterparty. Still, actual estate is an unique property course that's basic to comprehend and can enhance the risk-and-return profile of an investor's profile. On its own, genuine estate uses money circulation, tax breaks, equity building, competitive risk-adjusted returns, and a bush versus inflation.

Purchasing property can be an incredibly gratifying and rewarding undertaking, yet if you're like a great deal of new investors, you might be asking yourself WHY you should be buying property and what benefits it brings over various other financial investment opportunities. In enhancement to all the outstanding advantages that come along with investing in real estate, there are some downsides you need to take into consideration.

Not known Incorrect Statements About Property By Helander Llc

At BuyProperly, we use a fractional ownership design that allows capitalists to start with as little as $2500. One more major benefit of real estate investing is the capacity to make a high return from buying, restoring, and marketing (a.k.a.

Most flippers a lot of for undervalued buildings in structures neighborhoodsTerrific The remarkable point regarding spending in genuine estate is that the worth of the building is expected to value.

Not known Details About Property By Helander Llc

If you are charging $2,000 rental fee per month and you sustained $1,500 in tax-deductible costs per month, you will just be paying tax on that $500 earnings per month (Sandpoint Idaho land for sale). That's a big difference from paying tax obligations on $2,000 monthly. The revenue that you make on your rental device for the year is considered rental revenue and will certainly be strained as necessary

Report this page